AI Bubble Seeks Preemptive Bailout With Taxpayers Footing the Bill

OpenAI has all but explicitly asked for a preemptive taxpayer bailout to enhance the odds of achieving their ambitious spending plans.

The dynamics of the ongoing “everything bubble” can be seen most vividly in the artificial intelligence (“AI”) space.

The largest supplier of chips that provide the processing power for AI functionality is Nvidia, a company that commands a market cap of $4.8 trillion.

OpenAI is the most conspicuous consumer of this processing power, at least in terms of having the most recognizable applications. That company has been valued at $500 billion despite an annual revenue run rate under $20 billion and heavily negative free cash flow.

OpenAI and others in the industry have recently announced several high-profile commercial deals. At first blush, the numbers are staggering. OpenAI alone has announced plans for $1.4 trillion in commercial deals with business partners, to be spent over the next several years. Other participants in the industry have made similar announcements, resulting in a highly interconnected web of commercial arrangements that many have described as “circular.”

As the Wall Street Journal reported recently, focusing on the details of a “strategic partnership” between Nvidia and OpenAI:

The companies said Nvidia would invest as much as $100 billion in OpenAI, and that OpenAI is looking to buy millions of Nvidia’s specialized chips. That isn’t vendor financing, because it doesn’t involve a loan to finance a specific purchase. But it does look circular.

What precisely is happening here? If OpenAI is losing money at a rapid clip, how can it possibly support $1.4 trillion in planned spending? By the same token, why was it recently valued at $500 billion? Lastly, what does all of this say about the state of our economy and our attitude towards real business profits, speculation and gambling, stock market valuations, and the path to individual and corporate wealth?

30,000 Foot View of the AI Industry

As far as this outsider can tell, the focus of spending in the AI industry involves the accelerated buildout of “compute capacity” required to power AI applications, both existing and envisioned.

Compute capacity is provided by chips such as those produced by Nvidia, currently a highly profitable company – and the most valuable company in the world by market cap – at the center of the AI industry.

The sheer amount of compute capacity and processing power required to support existing and planned AI functionality entails the genesis of an entire industry of commercial real estate – data centers. These data centers are large physical buildings that house the chips and related processing power generation for AI applications. AI companies can have their own data centers, or they can buy/lease processing power generated by third parties in the latter’s data centers. An example of this arrangement is OpenAI’s recent announcement of a $300 billion partnership with Oracle.

From a conventional business perspective, the key question is whether the end products that pure play AI companies can offer will generate sufficient revenue – and subsequent profits – to provide a return on all that spending, should it actually occur. Recall, the suppliers of AI infrastructure and processing power (e.g., Nvidia, Oracle, etc.) are largely profitable but OpenAI is not.

The former group are the general stores selling picks and shovels, while AI pure plays like OpenAI are the miners who may or may not strike gold.

What is the Nature of Financial Success?

The holy grail for professional capital allocators is to invest in a business where required capital expenditures are limited, and revenue generation is both abundant and protected – not by government edict but by natural barriers to entry. Perhaps even more importantly, the executive management of the target business must be of high intelligence, ability, and integrity. With these ingredients in place, the expected result is a highly profitable business, delivering actual return on investment with the cash proceeds generated therefrom.

OpenAI misses every single one of the above standards, so why is it the subject of such intense investment, speculation, and focus? The answer lies in the culture surrounding our capital markets.

Recall that the world’s richest man is an inept businessman incapable of making a profit in any of his businesses. The former world’s richest man – currently #4 on the list – is also a serial money loser and has been for decades.

This context where the Altmans, Musks, and Bezoses accrue massive net worth while possessing minimal productive skills speaks to a disconnection of achievement from wealth.

Prior generations saw the world’s richest men – the most successful businessmen – deliver life-changing products and technologies to the masses.

Ford standardized the manufacture and assembly of the motor car. Rockefeller brought fossil fuel energy and its limitless applications to the entire world while ruthlessly cutting the cost of provision. Carnegie – another tireless cost cutter – optimized the steelmaking process and provided heavy industries with the best combination of cost and quality. All of these men controlled businesses that made massive profits.

Today, however, profit is an afterthought, replaced with hype and promises that never materialize but nevertheless pay off handsomely for the purveyors.

As monetary policy conducted by the Federal Reserve continues to act as a support structure for the political objectives of the US government, the goal necessarily has to be the propping up of asset bubbles into perpetuity. Higher asset prices provide the illusion of prosperity and some degree of political cover for successive administrations to carry on the obscene theatrics of the welfare-warfare state. In the business world, charlatans use these conditions to pursue lucrative rent-seeking opportunities.

But as these conditions persist, distortions become larger. Asset prices become unmoored from underlying performance to the extent that narrative surrounding asset prices becomes the dominant force in valuing those assets. Such is the case with OpenAI, a company that must produce trillions of dollars in profits – and therefore tens of trillions in revenue – over the next several years simply to pay for the commitments it has made as of today.

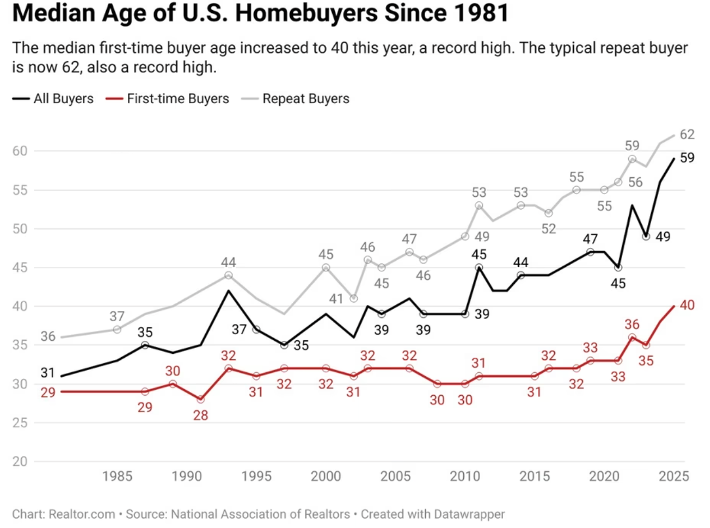

As participants in this racket accrue wealth for the time being, the middle class dwindles. Roughly 30% of Americans can’t afford a vacation this year. The median new homebuyer is now 40 years old. Remarkably, the median homebuyer overall was 39 years old in 2005 and is 59 years old today, 20 years later. In other words, the same people who bought homes 20 years ago comprise the buyer pool today. Younger potential buyers have been crowded out. A clearer signal of middle-class stagnation can hardly be imagined.

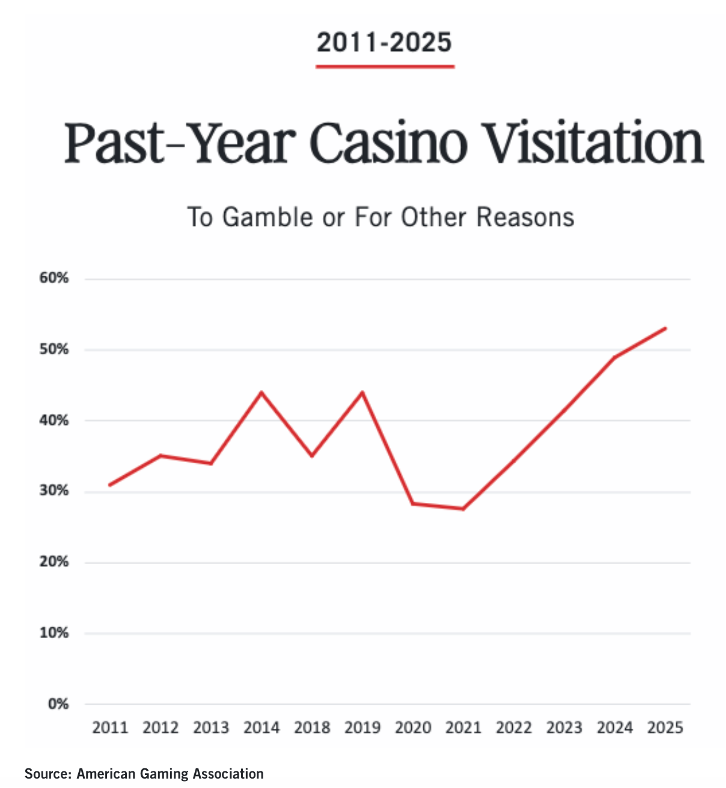

In the meantime, speculation and gambling are now mainstream and viewed as the best ways to stay ahead of persistent inflation. This cultural milieu, known as high time preference, can be viewed as a form of mass suicide, as the players are guaranteed to lose, setting in motion an aggressively vicious cycle of financial hardship and moral decay.

Unsurprisingly, much of this gambling has taken the form of stock trading margin accounts, aggregate balances of which recently hit at an all-time high.

Adding Insult to Injury

OpenAI has all but explicitly asked for a preemptive taxpayer bailout to enhance the odds of achieving their ambitious spending plans.

The company’s barely financially literate CFO suggested federal backstops – essentially credit guarantees – of AI infrastructure loans. This means a lower cost of capital for AI companies if things go well while the taxpayer funds a bailout of those companies if things go poorly.

The company’s CEO, in a panicked Twitter post, walked that language back while suggesting something just as bad – a Federal Reserve-like government buyer of last resort when it comes to computing power the AI companies can’t sell in the private markets. This means that when things go poorly, the American taxpayer will step in to buy AI computing power so that it doesn’t sit idle in data centers.

We’ve experienced bubbles before, but the longevity and magnitude of the current one are remarkable, as are its results. The contempt with which the profit and loss system is now regarded seems unprecedented, and the gall of industry players in seeking bailouts and subsidies at the cost of a speculation- and inflation-addled middle class is astounding.

To paraphrase a great philosopher, money now flows to those who deal, not in goods, but in favors. Men get far richer by graft and by pull than by work, and the laws of the country don’t protect you against them, but protect them against you. Corruption is rewarded and honesty is a self-sacrifice.

Strange economics driving this AI boom. Time will tell if it's total profligacy or messy first draft of a new industrial era... To be continued.